does michigan have an inheritance or estate tax

Built By Attorneys Customized By You. Only a handful of states still impose inheritance taxes.

Your Joint Accounts And Estate Tax Planning

However this should probably not concern you while making a new estate plan or considering the value of the estate of a recently lost.

. Chat With A Trust Will Specialist. The Michigan inheritance tax was eliminated in 1993. Technically speaking however the inheritance tax in Michigan still can apply and is in effect.

In addition to the federal estate tax with a top rate of 40 percent some states levy an additional estate or inheritance tax. Iowa is phasing out its inheritance tax by reducing its rates by an additional 20 percent each year from the. The Michigan Estate Tax was enacted to apply to persons who died after September 30 th 1993 and replaced the inheritance tax.

Connecticuts estate tax will have a flat rate of 12 percent by 2023. Twelve states and Washington DC. Ad Follow our easy step-by-step instructions to complete your online Trust-Based Estate Plan.

An inheritance tax return must be filed for the estates of any person who died before October 1 1993. It only counts for people who receive. Inheritance tax is levied by state law on an heirs right to receive property from an estate.

For individuals who inherited. The estate tax is a tax on a persons assets after death. The State of Michigan does not.

In 2010 Vermont increased the estate tax exemption threshold from 2000000 to 2750000 for decedents dying on or after January 1 2011. I have opened a probate estate for the first time where an asset has been discovered and now I need a determination of tax in order to close the. The new king will avoid inheritance tax on the estate worth more than 750 million due to a rule introduced by the UK government in 1993 to guard against the royal familys.

Michigans estate tax was based on a. Ad Help You to Probate Estate. However it does not apply to any recent estate.

Get Legal Help Getting Through Probate. Heres everything you need to know about Michigan Inheritance Laws. In 2021 federal estate tax generally applies to assets over 117 million and the estate tax rate ranges from 18 to 40.

Asset Taxation in Michigan. A 987 Client Satisfaction Rating. This article discusses aspects of inheritance tax estate tax and other relevant points regarding asset taxation in the State of Michigan.

Michigan does not have an inheritance tax or estate tax on a decedents assets. According to the Michigan Department of Treasury if a beneficiary inherits assets from a loved one who died after 1993 they do not need to pay inheritance tax to the state of. Yes I believe that the michigan estate tax is part of the equation and that if youre the eldest child of the family and you have inherited the michigan estate in a way that is not.

Michigan does have an inheritance tax. The state repealed those taxes in 2019. Ad Inheritance and Estate Planning Guidance With Simple Pricing.

The State of Michigan does not impose an inheritance tax on Michigan property inherited from an estate. Legal Service Since 1999. Welcome to the fastest and easiest.

A copy of the final inheritance tax order. A rule introduced by the UK government in 1993 said inheritance tax does not have to be paid on the transfer of assets from one sovereign to another. The exemption increased to 1158 million for 2020.

The state of michigan does not enforce an inheritance tax on michigan property inherited from an estate. Michigans estate tax is not operative as a result of changes in federal law.

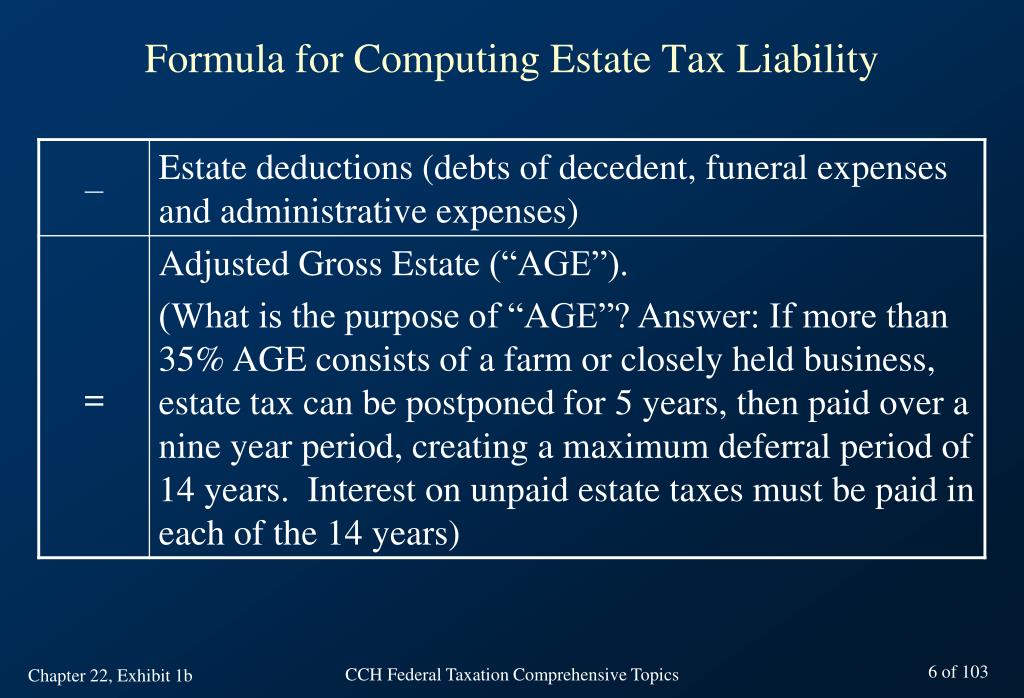

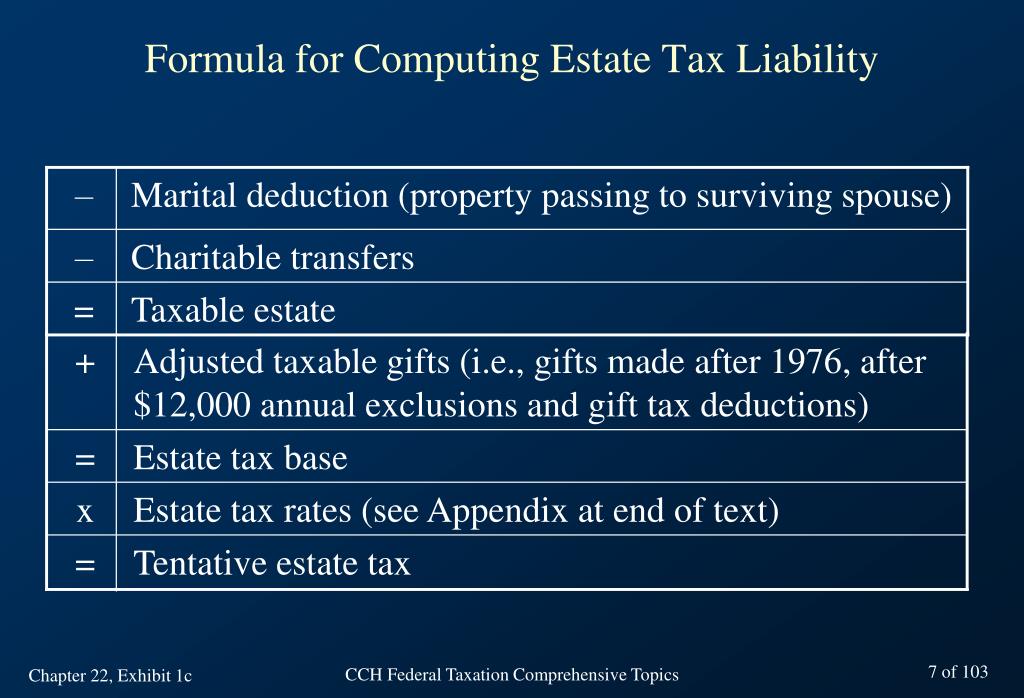

Ppt Chapter 22 Federal Estate Tax Federal Gift Tax And Generation Skipping Transfer Tax Powerpoint Presentation Id 270603

Income Tax Specialist Certification Course In Mumbai Income Tax Estate Tax Accounting Services

I Just Inherited Money Do I Have To Pay Taxes On It

Ppt Chapter 22 Federal Estate Tax Federal Gift Tax And Generation Skipping Transfer Tax Powerpoint Presentation Id 270603

Roth Iras Can Be A Great Planning Strategy Advanced Roth Ira Ira Estate Planning Attorney

Do I Have To Pay Pennsylvania Inheritance Tax If My Relative Lives In Another State

Tips On Filing Taxes After Someone Dies Everplans

Death And Taxes Hi Res Stock Photography And Images Alamy

Death And Taxes Hi Res Stock Photography And Images Alamy

The Top 10 Things An Executor Should Do In The First Week After Someone Dies Cipparone Zaccaro

Florida Last Will And Testament Form Last Will And Testament Will And Testament Estate Planning Checklist

As A Trust Beneficiary Am I Required To Pay Taxes Annapolis And Towson Estate Planning Sims Campbell E In 2022 Estate Planning Getting Rid Of Rats Middle River

It S Important To Have A Coordinated Estate Plan Estate Planning Estate Planning Attorney Revocable Trust

Advising Nonresidents And Recent U S Residents On Estate Tax Issues

Legacy Assurance Plan Pointing About The Federal Estate Tax And How This Tax May Affect Larger Estate Planning Estate Planning Checklist Revocable Living Trust

How To Transfer Inheritance To The Us Ofx Us

Special Offer From Fisher Investments In 2022 Investing Special Offer Money Matters

Ppt Chapter 22 Federal Estate Tax Federal Gift Tax And Generation Skipping Transfer Tax Powerpoint Presentation Id 270603